KEY TAKEAWAY: The competitive landscape for a commercial loan broker isn’t what you think. Three common myths obscure the real opportunity: that you’re fighting armies of brokers, competing head-to-head with banks, or trying to beat online lenders. The truth? Your job is to do what banks and online lenders simply cannot do. And when you do your job, competition evaporates.

Introduction: Three Myths OF LOAN BROKER COMPETITION

If you’re considering a career as a commercial loan broker, one of your top questions is probably: How much competition will I face?

Fair question. Banks abound. Online lenders dominate search results and social media feeds. And surely there must be thousands of other brokers already doing what you’re thinking about doing, right?

But here’s the surprising truth: The competition landscape for commercial loan brokers is built on three persistent myths. These are misunderstandings about who the real players are and what game they’re actually playing. These myths distort how prospective brokers see the opportunity and can keep even successful brokers from recognizing just how wide open the market really is.

Myth #1: “There are too many brokers. The market is saturated.”

Myth #2: “Banks are your direct competitors. They offer financing, just like brokers.”

Myth #3: “Online lenders are your newest competition.”

Each of these myths stems from a fundamental misunderstanding of what commercial loan brokers actually do. When you understand what’s really happening in the marketplace, you see that your path to success isn’t about out-competing banks or online lenders on their terms. It’s about delivering value they fundamentally cannot provide.

Let’s investigate these myths one by one.

Myth #1: Broker Competition Is Fierce

The Myth: “The market is saturated with commercial loan brokers. It’s impossible to stand out.”

The Reality: Most business owners and investors have never even met a commercial loan broker.

Let’s do a quick reality check. Think about your own network. How many real estate agents do you know? Five? Ten? Mortgage brokers? At least a couple. Insurance agents? You probably can’t even count them all.

Now, how many commercial loan brokers do you know?

If you’re like most people (including most business owners), the answer is zero. Maybe one, if you’re lucky.

Think you’re an outlier? Your network is different from everyone else? Go test it.

Walk into any networking event, business mixer, or even your local coffee shop. Ask around: “Who here knows a commercial loan broker?” Watch the blank stares. Maybe, just maybe, one hand goes up. Now ask about real estate agents, mortgage brokers, or insurance agents. Suddenly, the room lights up. Everyone knows at least a handful.

The Truth: Direct broker-to-broker competition is almost invisible. In most markets, you’re not fighting a crowd of other brokers for the same client. Most business owners and real estate investors don’t even know commercial loan brokers exist.

That’s not a problem. That’s an opportunity.

Myth #2: Banks Are Unbeatable Competition

The Myth: “Banks are everywhere. They have brand recognition, existing relationships, and unlimited resources. How can a broker compete with that?”

The Reality: Banks are ubiquitous, but they’re built to say “no” more than “yes.”

There are 65,000 FDIC-insured commercial bank branches in the U.S. Add credit unions, and you’re looking at over 85,000 branches around the country. Walk down any Main Street in America, and you’ll see banks on every corner.

When a business owner needs capital, their first instinct is to call their bank. It’s automatic. It’s comfortable. It’s what they’ve always done.

But here’s what they don’t realize: Banks sell products, not solutions. Their lending criteria are rigid. Their product menu is limited. If you don’t fit their box, you’re out of luck.

Here’s the fundamental difference between what banks offer and what brokers offer:

Banks are product sellers. They have a menu. They offer checking accounts, savings accounts, credit cards, business loans, commercial mortgages, maybe equipment or SBA loans. That’s it. That’s the menu. When you walk into a bank asking for financing, the banker’s job is to see if you fit into one of their existing product boxes. If you do, great. If you don’t, you’re shown the door.

Brokers are solution architects. A broker’s job isn’t to sell a product. It’s to design a capital solution that fits the client’s unique situation, goals, and timeline. As a broker you’re not limited to one institution’s lending criteria or product menu. You have access to hundreds of lenders, including regional banks, credit unions, SBA lenders, private lenders, CMBS conduits, life insurance companies, hard money lenders, mezzanine funds, and specialty finance companies.

The value difference is night and day:

Banks offer one answer. Brokers offer the best answer from hundreds of options.

Banks say “Here’s what we can do.” Brokers say “Here’s what you need, and here’s who can provide it.”

Banks optimize for their own lending goals. Brokers optimize for the client’s financial success.

Banks process applications. Brokers architect capital strategies.

Think of it this way: If you need a new kitchen, you could go to one cabinet manufacturer and buy whatever they have in stock. Or you could hire a designer who knows every manufacturer, every material, every style, and can create a custom solution that fits your space, your budget, and your vision perfectly. That’s the difference between a bank and a broker.

The Truth: Banks aren’t your competition because they can’t do what you do. They can only offer what they have on their shelf. They can’t curate specialized lenders across the market. They can’t craft a multi-year capital strategy. They can’t package a deal to maximize approval odds across multiple potential lenders.

Myth #3: Online Lenders Are The New Competition

The Myth: “Online lenders have the technology, the speed, and the marketing budget. They’re going to automate brokers out of existence.”

The Reality: Online lenders promise speed and simplicity, but they deliver commodity transactions, not strategic outcomes.

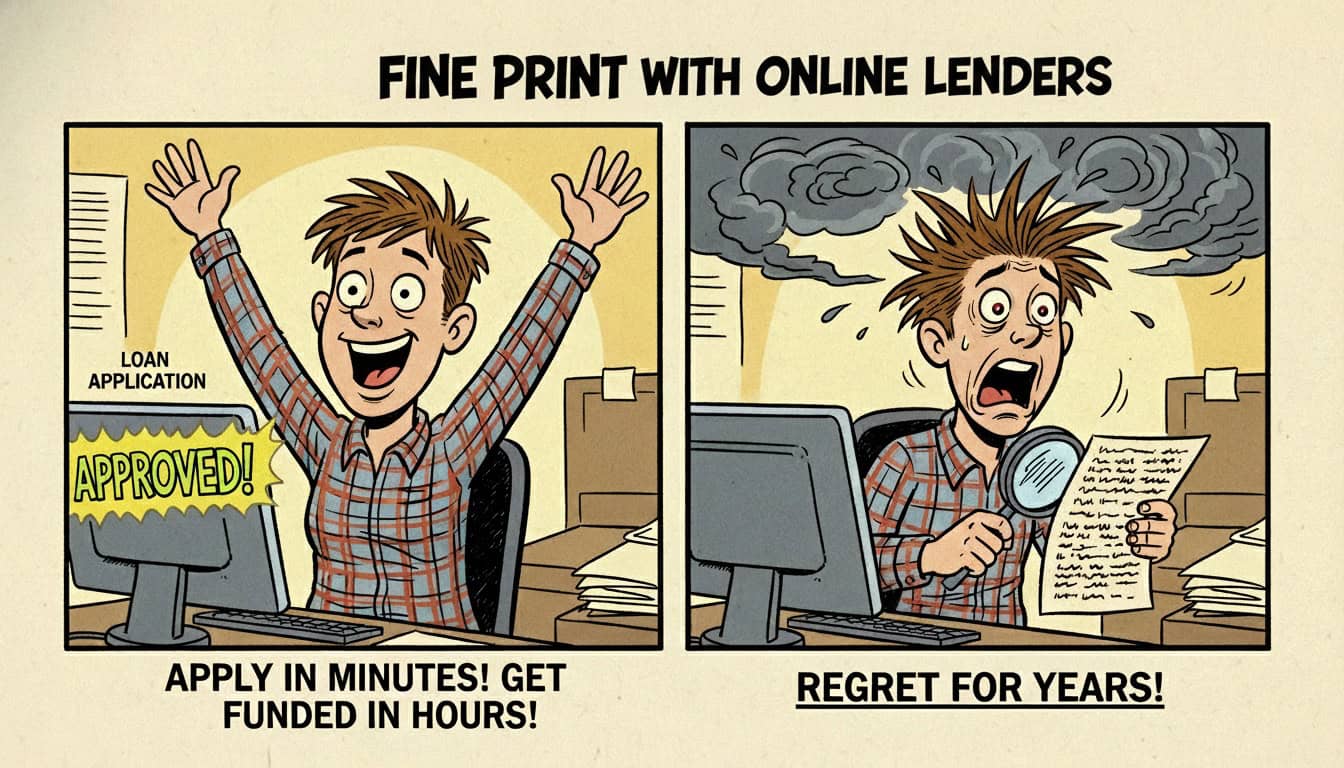

Their marketing is everywhere. Google, Facebook, LinkedIn. “Apply online in minutes. Get funded in hours.” Business owners see the ads. They click. They fill out a form. They get a quote. It feels easy. It feels modern.

But here’s what they don’t advertise: Most online applications get rejected. When approved, the terms are often worse than what a broker could negotiate with the same lender. There’s no strategy. No deal structuring. No client advocacy. It’s just a faceless algorithm matching applications to the highest bidding lender.

Here’s the fundamental difference between what online lenders offer and what brokers offer:

Online lenders are transactional platforms. They’ve optimized for speed and volume. Fill out a form, get matched with a lender, receive an offer, sign the docs, get funded. It’s efficient. It’s automated. But it’s also one-dimensional.

Brokers are strategic advisors. As a broker you don’t just match clients with lenders. You diagnose their capital needs, map out a multi-year growth strategy, identify the optimal lender for each phase, pre-negotiate terms, and package the deal for maximum approval odds. You’re not optimizing for the fastest transaction. You’re optimizing for the best long-term outcome.

This value difference is critical for clients:

Online lenders sell speed. Brokers sell strategic outcomes.

Online platforms optimize algorithms. Brokers optimize deal structures.

Online lenders deliver commodity transactions. Brokers deliver customized capital solutions.

Online platforms process forms. Brokers craft compelling narratives that get lenders to say “yes.”

Online lenders operate on autopilot. Brokers advocate, negotiate, and troubleshoot in real-time.

Here’s another way to think about it: If you need to book a vacation, you could use an automated travel site. You plug in your dates, pick the cheapest flight, book a hotel with good reviews, and call it done. Or you could work with a travel advisor who understands your destination because they’ve been there themselves a hundred times. They learn your preferences, know the best hidden gems, negotiate upgrades with the local tour companies, handle any issues that arise, and design an experience you’ll remember for years. One is fast and transactional. The other is strategic and personalized. That’s the difference between an online lender and a broker.

The Truth: Online lenders aren’t your competition because they can’t do what you do. They optimize for volume and speed, not for precision and partnership. They can’t dig into a client’s true goals, map a phased capital strategy, or pre-pitch lenders to gauge interest before submission.

The Real Opportunity: Do What They Cannot Do

Here’s what these three myths obscure: Your job isn’t to compete with banks and online lenders on their terms. Your job is to do what they fundamentally cannot do.

Banks sell what they have. You source what clients need.

Online lenders sell speed. You sell long-term strategic growth.

Banks and portals process applications. You architect capital solutions.

When you recognize this, the entire competitive landscape shifts. You’re not trying to be a better bank or a faster online lender. You’re offering something completely different – something they can’t replicate no matter how big their branch network or how slick their technology.

You become the capital strategist, the advocate, and the architect of your client’s financial future.

So how do you actually deliver on that promise? How do you position yourself as the obvious choice for business owners and investors who currently default to banks and online platforms?

It comes down to three core differentiators. These are the three ways great brokers deliver value that banks and online lenders simply cannot match.

How Great Brokers Eliminate Their Competition

Great brokers eliminate competition by making themselves the obvious, irresistible choice. Not just another option, but the only option that makes sense. They do this by stacking value in ways banks and online lenders can’t even touch.

Banks are built to say “no” more often than “yes.” Online lenders are built to churn through applications and spit out generic offers. But a great broker?

A great broker is a capital strategist, a matchmaker, and a deal architect, all rolled into one. They don’t just find loans. They build solutions. They don’t just submit paperwork. They craft a story that gets lenders to say “yes.”

And here’s the kicker: When you deliver this kind of value, you’re not just another broker. You’re the only broker your clients will ever need.

So let’s break down exactly how the best brokers pull this off. It’s not magic. It’s not luck. It’s a repeatable system built on three critical differentiators, each one a leg of the stool. Miss one, and the whole thing wobbles. Nail all three, and your competition is eliminated.

Differentiator #1: Strategic Advisory

Banks sell products. Online lenders sell speed. Great brokers sell long term strategic growth.

This strategic advisory process is what transforms you from a “loan finder” into a trusted advisor. It’s the difference between being a commodity and being indispensable.

Here’s how it works:

1. Clarifying Client Goals

Most clients walk in the door with a vague idea of what they want. “I need a loan.” “I want to buy a building.” “I need working capital.” But what they really need is someone to help them get clear on their true objectives. Growth? Acquisition? Debt consolidation? Expansion? Each goal demands a different approach.

A great broker doesn’t just take orders. They dig deep. They ask the right questions. They uncover the real motivations behind the request. Sometimes, the client’s initial ask isn’t even the right solution. Maybe they need a line of credit, not a term loan. Maybe a bridge loan makes more sense than a permanent mortgage. Maybe they’re thinking too small, or too big.

2. Mapping Capital Strategies

Once the goal is clear, the real work begins. This is where you earn your stripes as a strategist. You analyze the client’s financials, their business model, their growth plans. You look at the big picture. Then you map out the best capital strategy to get them where they want to go.

Maybe it’s a phased approach where you start with a short-term loan, then refinance into a long-term facility once certain milestones are hit. Maybe it’s layering different types of financing to optimize cash flow and minimize risk. In every case, you are mapping how they can leverage capital strategically over time to achieve their goals.

3. Building a Phased Plan

Banks and online lenders are transactional. They want to close the deal and move on. But you? You’re building a relationship. You’re creating a roadmap for the client’s capital needs over the coming decade.

You become the architect of their financial future. You give them clarity, confidence, and a sense of direction. Suddenly, you’re not just a broker. You’re their go-to advisor for every major financial decision.

Bottom line: Banks sell their products, not a step-by-step strategy. Algorithms don’t strategize, either. With a commercial loan broker, clients get clarity, sequencing, and confidence, not just a yes/no answer.

Differentiator #2: Lender Matchmaking

Your second tool for eliminating competition is lender matchmaking. Banks have one set of products. Online lenders have a handful of programs and a faceless algorithm. But a great broker, like you, has a network.

But it’s not even about who you know. It’s about how well you know them, and how you leverage those relationships to get your clients the best possible deal.

1. Curating Lenders

A great broker doesn’t just have a list of lenders. You have a curated network. You know which lenders love construction deals, which ones specialize in hospitality, which ones are hungry for owner-occupied real estate, and which ones will bend over backward for a strong sponsor with a quirky property.

You keep your finger on the pulse. You know who’s lending, who’s tightening up, who’s got new programs, and who’s just window dressing. And this knowledge gives your clients an edge.

2. Matching Lender Appetite to Deal Profile

Every deal is unique, and every lender has a different appetite. Great brokers take everything – the client’s project narrative, deal size, location, industry, collateral, credit, cashflow – and align it with the exact lenders most likely to bite.

You don’t shotgun the deal to every lender in your Rolodex. You handpick the best fits. You pre-pitch the deal, gauge interest, and only then do you make the introduction. This isn’t spray-and-pray. This is sniper-level precision.

3. Pre-Pitching Lenders

Before you ever submit a package, you’re already working the phones. You’re floating the deal to your top contacts. You’re getting feedback, tweaking the story, and making sure the deal is positioned perfectly. By the time the formal package lands on the lender’s desk, they’re already primed to say “yes.”

Bottom line: A bank is one lender and they don’t refer out to better-fit competitors. Portals optimize for speed and volume, not nuanced lender fit. With a commercial loan broker, clients get tailor-targeted loan placement.

Differentiator #3: Packaging for Approval

Packaging for approval is the art and science of making your client’s deal irresistible to lenders. It’s about storytelling, strategy, and relentless attention to detail.

1. Crafting the Narrative

Every deal has a story. Your job is to tell it in a way that makes lenders lean in, not lean back. You highlight the strengths. You address the weaknesses before the lender even asks. You anticipate objections and answer them in advance.

You don’t just dump documents in a Dropbox and hope for the best. You craft a narrative that makes the deal make sense. You show how the client’s experience, the property’s potential, and the market dynamics all line up for success.

2. Assembling Documentation

Lenders are busy. Underwriters are even busier. The last thing they want is a messy, incomplete package that raises more questions than it answers. You make their job easy. You assemble every document, spreadsheet, and supporting piece of evidence so that it is clean, organized, and ready for review.

You know what each lender wants to see. You know their hot buttons. And so you present the numbers, the projections, the comps, and the business plan in a way that checks every box.

3. Highlighting Strengths

This is where you shine. You don’t just present the facts. You spotlight the strengths. You show why this client is a winner. You explain why this deal is a safe bet. You make the lender feel like they’d be crazy to pass it up.

And if there are weaknesses? You don’t hide them. You address them head-on. You show how the risks are mitigated, how the client has a plan, how the structure protects everyone involved.

Bottom line: Bankers and online platforms underwrite based on the application submitted. They don’t review your draft package first and tell you how to rework your proforma, or how to mitigate certain risks. They underwrite the application they receive. It is only commercial loan brokers who work to make sure that application the lender receives is the right application.

Putting It All Together: Competing by Not Competing

When you properly position your value, you’re not competing anymore. You’re not begging prospects to choose you over the bank down the street or the first lender they find on Google.

Instead, you’ve elevated yourself above the fray. You’ve become something banks and online lenders simply can’t be: a strategic partner, a deal architect, and a client advocate rolled into one.

The mindset shift is everything.

When clients and referral partners see you as a capital strategist and advocate, you become the default choice. They choose you not because you can find them money, but because you can find the right money, structured the right way, at the right time, for the right terms.

Here is your positioning statement:

“We design your capital plan, source the right lender, and package your deal for approval – things a bank or portal simply doesn’t do.”

When you differentiate on role, not rate, competition effectively disappears. Banks and online lenders aren’t even in the same league. And as for other commercial loan brokers? There are so few, you’ll rarely bump into them. And if you do? Chances are high they aren’t operating at this level and showing their value with this kind of clarity and confidence.

Practical Messaging You Can Use

You’ve got the theory locked in by now, so let’s get tactical. To eliminate competition, you have to communicate your unique value in a succinct and compelling way. Here’s how to make your value crystal clear to both prospects and referral partners.

For Prospects

You’re not just another option. You’re the only one who brings strategy, access, and advocacy to the table. Here’s how to say it:

Banks sell what they have. We source what you need. Banks are limited by their own products. We’re not. We go to the entire market to find the best fit for your unique situation.

One application isn’t a strategy. We build a capital roadmap. Anyone can fill out a form. We map out your capital needs for the next year, five years, or decade, so you’re never boxed in by a short-term decision.

We turn a pile of documents into a lender-ready story. Lenders don’t fund paperwork. They fund stories that make sense. We package your deal so it’s not just complete – it’s compelling.

For Referral Partners (CPAs, Attorneys, CRE Brokers)

Referral partners are your secret weapon. But they need to know you’re not just another broker. You’re the one who makes their job easier and their clients happier. Here’s how that might look for different referral partners:

For CPAs: We specialize in optimizing capital structures for tax efficiency and cash flow. Plus, we keep you in the loop throughout the process. Your clients get better outcomes, and you look like a hero.

For Attorneys: We handle all the financing complexity so your client can stay focused on running their business. Our clients close faster and at better terms than bank-only borrowers, which makes your job easier and your clients happier.

For Commercial Real Estate Agents: Your deals close faster, your clients get better terms, and you never have to worry about financing falling through at the last minute.

Common Objections and How to Address Them

In any sales conversation, objections can occur. Think of them as questions. Each one is the client highlighting a piece of the puzzle they don’t yet understand and asking you to explain it. Here are the word for word scripts you can use in real client conversations:

“I’ll just start with my bank.”

Great relationships matter. We complement that by bringing multiple options and doing the framing and packaging that improves your odds of approval. This even works with your bank. In fact, we often help clients get approved at their own bank by presenting the deal in a way that checks every box for the underwriter. Why settle for one shot when you can have a whole team working for you?

“I can apply online in five minutes.”

“Speed is helpful, but not if it leads to declines or expensive terms. Our process trades 20 minutes in conversation so you can get the right lender and a stronger yes. Most online applications get rejected or come back with high rates and rigid terms. We make sure your deal is positioned for the best possible outcome, not just the fastest answer.

“Do brokers cost more?”

Our job is to improve total economics: rate, terms, covenants, and certainty. Our mission is to create a better net outcome for each client than they would be able to achieve on their own by going direct to a lender. In most cases, our fee is paid by the lender at closing, and we often save clients more in better rates and terms than our fee costs. Would you rather pay nothing and get mediocre terms, or pay nothing and get optimal terms?

“We’ve always used [Bank X].”

“If that makes sense for your day-to-day banking. Keep doing that. But for major capital decisions, let us show you what else is available. You might discover options that are perfect for your situation that [Bank X] simply doesn’t offer. Worst case, you confirm that [Bank X] is your best option – but at least you’ll know for sure.”

Conclusion: The Real Answer to “What’s Competition Like?”

Ok, let’s sum up.

Direct broker competition is almost nonexistent. Most business owners and investors have never even met a commercial loan broker. Banks and online lenders, on the other hand, are highly visible to your clients. But they don’t offer what you do, which means they’re not your competition.

When you lead with strategy, matchmaking, and packaging, you become the obvious choice. You’re not just another place to apply. You’re the capital strategist, the advocate, and the architect of your client’s financial future.

Competition is eliminated through crisp positioning – consistently communicating your unique value in a simple and compelling way.

Ready to turn this insight into consistent wins?

At Commercial Loan Broker Institute, we provide commercial loan brokers with training, education, mentoring, and community. You get access to a full lender network, done for you branding and marketing campaigns, and the tools and resources (including software and CRM) that let you stand out and scale up.

Learn more about our programs or start with a short strategy call. We’ll help you identify your niche, sharpen your story, and equip your brokerage to stand out. Because in this business, the first broker in the door usually wins the deal, and the client for life.